Deadline for filing Income Tax Returns (ITR) for the financial year 2020-21 or AY 2021-22 has been again extended by the Central Board of Direct Taxes (CBDT) in a bid to provide relief to taxpayers. The new deadline for filing ITR has been shifted from September 30 to December 31, 2021.

Check list of documents required during return file of ITR-1 or Sahaj.

1)Pan and Aadhar card number.

2)Form-16 from employer.

3)Rent Receipt and House loan amount statement for deduction of statement.

4)Other sources:Bank statement or passbook for interest on saving and on fixed deposits.

5)Claim of deduction under chapter VI-A:

a)Your contribution to PF/NPS.

b)Your Children's school tuition fees.

c)Life insurance premium reciept.

d)Stamp duty and registration charges.

e)Principal repayment on your home loan.

f)Equity Linked Saving Scheme/Mutual funds investments.

g)Reciept with details of donations eligible for 80G.

h)The aggregate amount of deduction admissible u/s 80C, 80CCC AND 80CCD(1) and shall be restricted to maximum limit of Rs 1.5 lakh.

6. Fill up Schedule Dl if you have made any investment/deposit/payments between April 1, 2020 to July 31, 3030 for the purpose of claiming any deduction under Part B of Chapter VIA.

7. Tax Payment Details

Verify the tax payment details as available in your form 26AS.

8. TDS Details

Verify the TAN details and the amount of credit available in your form 16 (For salary), 16A (non Salary) and 16C (Rent)

9. Other information

Exempt income like agricultural income, dividend (only for reporting purpose).

Tax Slabs for Fy 2020-21:

Individuals and HUFs can opt for the Existing Tax Regime or the New Tax Regime with lower rate of taxation (u/s 115 BAC of the Income Tax Act).

The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions (like 80C, 80D,80TTB, HRA) available in the Existing Tax Regime.

The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions (like 80C, 80D,80TTB, HRA) available in the Existing Tax Regime.

For Individual (resident or non-resident) less than 60 years of age anytime during the previous year:

| ||||||||||||||||||||||||||||||||||||

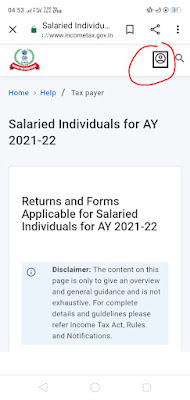

For details visitsite:

Following screenshot may help for site visit.

Comments

Post a Comment

If any doubts let me know..